Wisconsin Tax Id Number

There are 4 Tax IDs

A Federal Tax ID EIN $29

Employer Identification Number

This Federal Tax ID is used as an employer ID as well as a business tax ID number and an ID for nonprofits, associations etc.

Get it Now!A Sales Tax ID Number $39

Also Called a Seller's Permit, Wholesale ID, Resale, Reseller ID.

You need that to buy wholesale, sell retail, or sell wholesale as well as to lease tangible goods.

Get it Now!A State EIN $39

This is the state version of an employer ID number.

It is only for employers, who MUST obtain both a federal EIN as well as a state EIN.

Get it Now!A Business Tax ID $39

Business/Occupational/Business Tax Receipt Number

This is a general business tax number also called a Tax ID or home occupation permit that all businesess MUST obtain.

Get it Now!In Wisconsin, taxable sales are registered and paid to the state with a state sales tax id number.

Click to Find Out if You Need Wisconsin WI Tax ID Number(s).

THERE ARE 4 TAX ID NUMBERS

Why

Apply?

It is important that you apply for a federal Employer Identification

Number (EIN) , since state application forms will require you to

provide this number.

This is a nine-digit number assigned to sole

proprietors, corporations, partnerships, estates, trusts, nonprofit

organizations, farmers' cooperatives, and other entities for tax

filing, reporting purposes, and establishing your business tax

account. You will use our online form to apply for the EIN.

New to the Business: If new owner of an existing business, you

cannot use the EIN of the previous owner. If you already have an

EIN, use that number.

For more detailed information on who must file, help with filing the

tax id form, when to apply for a new EIN, and how to apply for EIN,

please read below.

Legally Required Tax Id Numbersin wisconsin

If You Are Starting a Business, You May Need a Tax Id Number Number

When Starting a Business, all businesses, including home based businesses, internet businesses, eBay, online web sites, professional practices, contractors or any other business, in Wisconsin are required to identify their business with one of two numbers: either a Social Security number or an EIN or employer identification tax id number.

A Social Security number can be used on all your government tax id number forms and other tax id number official documents, if you are a sole proprietor, but most small business advisors recommend that you apply for a Federal Tax Id Number (EIN) and use that number instead.

Here is where you will need to use this federal Tax Id Number : All corporations, employers, and those that need to use a business Tax Id Number # instead of their SS#, are required to have it.

Also, in tax resale certificates and some other business tax forms , you are required to provide this number.

Click to Find Out if You Need Wisconsin WI Tax ID Number(s).

How to get your Tax Id Number - Tax ID Numbers - How to Apply and Obtain a Tax Id NumberHow do I get tax ID numbers?

Every business needs its own Tax Id Number. To get a federal Tax Id Number , state Tax Id Number , or seller's number, click here.Once the federal government issues you a tax identification number , you will have to get a state Tax Id Number from Wisconsin as well. Find out more here, or ask your lawyer, bookkeeper or accountant to do this for you.

Here's a Few Other Tax Documents and Business Permits You May Need When Starting a Small Business

In Wisconsin , If you use a name other than your own personal name to operate a business, you are legally required to file a DBA Certificate , also known as a dba (doing business as) form.

A corporation or llc, is probably the best and cheapest insurance for you and your new small business if you want to limit your civil, tax, and personal liability.

If you buy or sell wholesale or retail in Wisconsin and the goods or items bought or sold are taxable, you need a Reseller License or Wholesale License.

If you will hire employees you are required to obtain a federal tax id number (Employer Identification Number EIN) as well as a state Tax Id Number as well (for Wisconsin ).

In most cases, you are required to get an Wisconsin or state permit or Tax ID , even if you are working from home or you have an online business or selling on ebay- but note: 99.9 percent of all businesses are required to have a Tax ID or business tax registration certificate ( both the same).

State Tax Id Number / Employer Id Number EIN

Businesses that are employers are required to obtain a State Tax Id (EIN) and a Federal Tax Id (FEIN) NOTE: Sole owners can use a federal Tax Id Number to build business credit. Click Here to File Your Tax Id Number Fees How Long Does it Take? Back to Top

Wholesale License Number / Resale / Reseller's License / Tax Id Number

Wholesalers, retailers of taxable goods / services require a Wholesale License / Wholesale License Number / Reseller License. Click Here to File Your Wholesale License Fees How Long Does it Take? Back to Top

Federal Tax Id Employer Identification Number FEIN

Corporations or LLCs, employers, and, in some states, those businesses that are also getting a Wholesale License are required to obtain a Federal Tax Id (FEIN) and a Tax ID. Click Here to File Your Tax Id Number Fees How Long Does it Take? Back to Top

How long does the process take to get a tax id Number I want to open a checking account.

Federal Tax Id Number (1- 24 hours) - We send you the Tax Id Number by Email to use to open your business bank account. Note, the government will send you a welcome package within 1-2 weeks..

State Tax Id Number (Employer Number) varies but average time is 1-8 DAYS - could take longer in some states. In some states, we file on the same day we receive your order; however, note that it may take a few days for the government to mail you the certificate.

Wholesale License may take 1- 5 but may take as long as 3-10 business days because there are special processing requirements (e.g., if you have high projected gross sales - e.g., 50,000 per year, some states may require a deposit. Or if you don't provide all requested info such as a SS#, it may take longer to process. ) In some states, we file on the same day we receive your order; however, note that it may take a few days for the government to mail you the certificate.

If you are a sole proprietor with employees, or you are a

partnership or incorporated, you will have to get a federal tax ID

number, also known as an Employer Identification Number (EIN).

You use your EIN for filing and paying for withholding and social security taxes you are required to pay.

To get an EIN, you fill out and file Form.

You may also be required to get a separate state tax ID number.

We can get it for you. We make

checks with the state agency for the correct tax id forms.

Tax Id Number for the State of Wisconsin

Click to Find Out if You Need Wisconsin WI Tax ID Number(s).

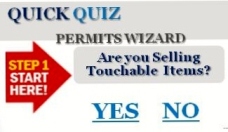

more info

Take

Our Short Quiz

2 Minute Quiz

Tells You What You Need

How Do I Get a Tax ID?

Submit An Online Form

Just Your Business Information

Your name and address as well as the name of the business and address, type of business and number of employees.

Get it Now!Select Licenses and Submit the Form

Submit Your Completed Form

As soon as you submit the form, we will have your business information in a 3rd party secure database.

Get it Now!Pay Online for the Items

Purchase what you need

After you submit your form, you will be directed to a payment form. Just enter billing information and check out.

Get it Now!We Will Register Your Business

We will file and mail/email you.

For example, we will register your seller's permit, file your dba and publish it in a legal newspaper or set up your LLC and provide a customized LLC agreement etc. and will mail or email you the filed official certificates..

Get it Now!How It Works

Submit An Online Form

Just Your Business Information

Your name and address as well as the name of the business and address, type of business and number of employees.

Get it Now!Select Licenses and Submit the Form

Submit Your Completed Form

As soon as you submit the form, we will have your business information in a 3rd party secure database.

Get it Now!Pay Online for the Items

Purchase what you need

After you submit your form, you will be directed to a payment form. Just enter billing information and check out.

Get it Now!We Will Register Your Business

We will file and mail/email you.

For example, we will register your seller's permit, file your dba and publish it in a legal newspaper or set up your LLC and provide a customized LLC agreement etc. and will mail or email you the filed official certificates..

Get it Now!Years of Experience

Successful Projects (not a typo!)

Partner Programs

Chat Support

Get in Touch

With Us

Please note that we are unable to return long distance calls unless it is a toll-free number.

- Telephone:

- +1 954-600-9593

- E-mail:

- support@Tax-ID-Number.Info