Washington Tax Id Number

There are 4 Tax IDs

A Federal Tax ID EIN $29

Employer Identification Number

This Federal Tax ID is used as an employer ID as well as a business tax ID number and an ID for nonprofits, associations etc.

Get it Now!A Sales Tax ID Number $39

Also Called a Seller's Permit, Wholesale ID, Resale, Reseller ID.

You need that to buy wholesale, sell retail, or sell wholesale as well as to lease tangible goods.

Get it Now!A State EIN $39

This is the state version of an employer ID number.

It is only for employers, who MUST obtain both a federal EIN as well as a state EIN.

Get it Now!A Business Tax ID $39

Business/Occupational/Business Tax Receipt Number

This is a general business tax number also called a Tax ID or home occupation permit that all businesess MUST obtain.

Get it Now!The state of Washington requires new businesses to obtain an occupational business tax license and a seller's tax license if they conduct taxable sales.

Click to Find Out if You Need Washington (WA) Tax ID Number(s).

Need a Tax ID Number in Washington?

Here you can Apply for a Tax Id Number in Washington. We offer an easy way to apply for a Washington Tax Id Number Online.

A Washington tax identification number (also know as an employer identification number or EIN), or a Sales Tax Id Seller's Permit Number, is a number assigned to your business by the IRS and / or by the State.

Your tax ID number is used to identify your business to several government agencies who regulate businesses.

Any business offering products or services in Washington that are taxed in any way must get a seller's permit tax id, and federal tax ID number as well as a state employer tax id if the business is an employer.

In fact, any business that is an employer and collects or pays sales taxes will need a seller's permit tax id number and a federal tax ID as well as a state ein.

Get your Washington Tax ID (EIN)

If you get a Federal tax id, it is good in all states, including Washington.

* Individuals / Sole Proprietorships

* Corporations in Washington

* S-Corporations in Washington

* Limited Liability Companies (LLC)

* Partnerships in Washington

* Non-ProfitsClick to Find Out if You Need Washington (WA) Tax ID Number(s).

WA Legally Required Tax Id Numbers

If You Are Starting a Business, You May Need a Tax Id Number Number

When Starting a Business, all businesses, including home based businesses, internet businesses, ebay, online web sites, professional practices, contractors or any other business, in Washington are required to identify their business with one of two numbers: either a Social Security number or an EIN or employer identification tax id number.

A Social Security number can be used on all your government tax id number forms and other tax id number official documents, if you are a sole proprietor, but most small business advisors recommend that you apply for a Federal Tax Id Number (EIN) and use that number instead.

Here is where you will need to use this federal Tax Id Number : All corporations, employers, and those that need to use a business Tax Id Number # instead of their SS#, are required to have it.

Also, in tax resale certificates and some other business tax forms , you are required to provide this number.

How to get your Tax Id Number - Tax ID Numbers - How to Apply and Obtain a Tax Id NumberClick to Find Out if You Need Washington (WA) Tax ID Number(s).

How do I get tax ID numbers?

Every business needs its own Tax Id Number. To get a federal Tax Id Number , state Tax Id Number , or seller's number, click here.Once the federal government issues you a tax identification number , you will have to get a state Tax Id Number from Washington as well. Find out more here, or ask your lawyer, bookkeeper or accountant to do this for you.

Here's a Few Other Tax Documents and Business Permits You May Need When Starting a Small Business

In Washington, If you use a name other than your own personal name to operate a business, you are legally required to file a DBA Certificate , also known as a dba (doing business as) form.

A corporation or llc, is probably the best and cheapest insurance for you and your new small business if you want to limit your civil, tax, and personal liability.

If you buy or sell wholesale or retail in Washington and the goods or items bought or sold are taxable, you need a Reseller License or Wholesale License.

If you will hire employees you are required to obtain a federal tax id number (Employer Identification Number EIN) as well as a state Tax Id Number as well (for Washington ).

In most cases, you are required to get an Washington or state permit or Tax ID , even if you are working from home or you have an online business or selling on ebay- but note: 99.9 percent of all businesses are required to have a Tax ID or business tax registration certificate ( both the same).

State Tax Id Number / Employer Id Number EIN

Businesses that are employers are required to obtain a State Tax Id (EIN) and a Federal Tax Id (FEIN) NOTE: Sole owners can use a federal Tax Id Number to build business credit. Click Here to File Your Tax Id Number Fees How Long Does it Take? Back to Top

Wholesale License Number / Resale / Reseller's License / Tax Id Number

Wholesalers, retailers of taxable goods / services require a Wholesale License / Wholesale License Number / Reseller License. Click Here to File Your Wholesale License Fees How Long Does it Take? Back to Top

Federal Tax Id Employer Identification Number FEIN

Corporations or LLCs, employers, and, in some states, those businesses that are also getting a Wholesale License are required to obtain a Federal Tax Id (FEIN) and a Tax ID.

Click to Find Out if You Need Washington (WA) Tax ID Number(s).

more info

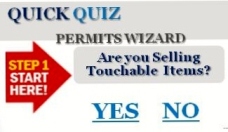

Take

Our Short Quiz

2 Minute Quiz

Tells You What You Need

How Do I Get a Tax ID?

Submit An Online Form

Just Your Business Information

Your name and address as well as the name of the business and address, type of business and number of employees.

Get it Now!Select Licenses and Submit the Form

Submit Your Completed Form

As soon as you submit the form, we will have your business information in a 3rd party secure database.

Get it Now!Pay Online for the Items

Purchase what you need

After you submit your form, you will be directed to a payment form. Just enter billing information and check out.

Get it Now!We Will Register Your Business

We will file and mail/email you.

For example, we will register your seller's permit, file your dba and publish it in a legal newspaper or set up your LLC and provide a customized LLC agreement etc. and will mail or email you the filed official certificates..

Get it Now!How It Works

Submit An Online Form

Just Your Business Information

Your name and address as well as the name of the business and address, type of business and number of employees.

Get it Now!Select Licenses and Submit the Form

Submit Your Completed Form

As soon as you submit the form, we will have your business information in a 3rd party secure database.

Get it Now!Pay Online for the Items

Purchase what you need

After you submit your form, you will be directed to a payment form. Just enter billing information and check out.

Get it Now!We Will Register Your Business

We will file and mail/email you.

For example, we will register your seller's permit, file your dba and publish it in a legal newspaper or set up your LLC and provide a customized LLC agreement etc. and will mail or email you the filed official certificates..

Get it Now!Years of Experience

Successful Projects (not a typo!)

Partner Programs

Chat Support

Get in Touch

With Us

Please note that we are unable to return long distance calls unless it is a toll-free number.

- Telephone:

- +1 954-600-9593

- E-mail:

- support@Tax-ID-Number.Info